🖨️ Print post

🖨️ Print post

By the mid-2000s, it looked to many as a certainty that the United States’ days as a major hydrocarbon-producing power were in the rear-view mirror. The Malthusian predictions of Shell geoscientist Marion King “M. King” Hubbert seemingly had come to fruition. In 1956, he famously predicted that U.S. oil production would peak between 1965 and 1970, before beginning an irreversible and terminal decline regardless of price and drilling activity. The world would reach the same production plateau and terminal decline inflection point by the mid-1990s, according to Hubbert.

It should be noted that “peak oil” was not at that time a new concept. The first public decrees began when the Pennsylvania oil fields began to run dry in the 1880s. Similar flare-ups of peak oil alarmism occurred in the 1920s, the 1940s and the 1960s, and continue to the present day. Yet each time, the same combination of factors has proved these prognostications to be illusory. In fact, when an oil deficit results in high prices, high prices incentivize experimentation and technology development; then, new tools result in increased production, the shortage becomes surplus and prices subside. This pattern has repeated at least five times in the past one hundred fifty years.

THE DEMAND-PRODUCTION GAP

In 2008, U.S. crude oil production had fallen to five million barrels per day (bpd)—representing approximately 5 percent of total global production—down about 50 percent from the Hubbert predicted peak of 9.6 million barrels per day in 1970. Production of crude oil’s hydrocarbon cousin, natural gas liquids (NGLs), remained virtually unchanged at roughly 1.5 million bpd over this same time frame. (NGLs are molecules that are a gas at ambient conditions but a liquid when refrigerated or pressurized. These molecules—ethane, propane, butanes and pentanes—are produced from oil or gas, usually separated and sold as stand-alone products.) Combined production of liquid petroleum (crude oil plus NGLs) had fallen from 11.1 million bpd in 1970 to 6.5 million bpd by 2008.

During this time frame (1970–2008), U.S. consumption (demand) of liquid petroleum products increased from roughly fifteen million bpd to twenty million bpd, with the difference between demand and domestic production widening to almost fifteen million bpd. All of the difference was supplied through imports, some of it via interconnecting pipelines from Canada, but most of it via waterborne imports from the Middle East, Russia or the former Soviet Union (USSR), Mexico, Venezuela and West Africa. By 2008, OPEC’s market share had risen to 45 percent of all global crude oil production, up from its nadir of less than 30 percent in the early 1980s. (OPEC market control in the early ‘80s was driven by several factors, including the 1979 Iranian Revolution, the Iran-Iraq War and a surge in production from Alaska’s North Slope, the UK-Norway North Sea, West Africa and the USSR.)

The picture on the U.S. natural gas side of the hydrocarbon equation was no less bleak. In 2005, U.S. dry natural gas production averaged roughly fifty billion standard cubic feet per day (scfpd), declining about ten billion scfpd from the early 1970s. Note that comparing different units or forms of energy can be confusing, as solid-liquid-gaseous forms of energy are all measured differently. In energy-equivalent terms, fifty billion scfpd of natural gas works out to roughly 9.1 million barrels of oil equivalent per day (boepd).

Over that period, natural gas demand was growing. Environmental regulations had dented the “cheapness” of coal, and many utility providers had identified natural gas as the environmentally “cleanest” substitute for the much maligned coal. To counter the dynamic of falling production and growing demand, the U.S. had constructed, or was constructing, eight liquefied natural gas (LNG) import terminals, capable of regasifying almost ten billion scfpd of natural gas. It was expected that LNG imports would comprise 25 percent of U.S. natural gas demand by 2015, with likely supply coming from Qatar, Russia, Indonesia, Trinidad & Tobago and Algeria.

By July 2008—the high-water mark of the energy scarcity situation of the mid-2000s—the international price of oil had reached $145 per barrel ($175 per barrel in 2022 inflation-adjusted terms) and the U.S. natural gas price had reached $12.70 per million BTU ($75 per barrel in energy-equivalent terms—one barrel of oil equivalent equals 5.7 million BTUs). These record-level energy prices were driven by a multitude of factors, including stagnant production in the U.S., surging demand from China and India, and the fallout from the second Persian Gulf War. For the U.S., the situation looked particularly unappealing, portending a future where all incremental energy usage—and, by historical correlation, future GDP growth—would require “funding” in large part through imported energy from halfway around the world.

A NEW PARADIGM

As the paradigm of energy scarcity took hold in the mid-2000s and influenced the collective geopolitical conventional wisdom of the day, something transformative was occurring, literally and figuratively, just below the surface. A close look at official statistics started to show that, counterintuitively, U.S. natural gas production was growing, when all other hydrocarbon production in the U.S. was declining. From 2005 to 2008, U.S. dry natural gas production had increased from fifty to fifty-five billion scfpd, an increase of 10 percent. Most of this unexpected increase in production was coming from a new type of drilling and production technique from a previously discounted type of geologic formation. The new technique would come to be known as “unconventional drilling”—and later, hydraulic fracturing or fracking—and the formation type, high-density rock, would be known as shale.

It helps to understand a bit about the geologic process that forms the basis of the modern oil and gas industry, a process that involves the continual movement of Earth’s tectonic plates. As the oil and gas conversion process occurs, it changes form into liquid and eventually to gas. Through geologic migration, these fluids travel upwards into porous rocks, usually sandstone or carbonates. These, along with sedimentary shale, become what is known as oil and gas “source rocks.” Eventually, some of this oil will migrate to the surface through “oil seeps” or be exposed through earthquakes and other plate tectonic movements. Every now and then, a much denser or non-porous rock, such as ionic salt or granite, forms or moves into place above the source rock, forming a seal—the caprock—that traps the oil and gas in place in what are called reservoirs.

The modern oil and gas industry involves the search for and exploitation of these ancient source rocks and the unique places where the source rocks’ organic bounty has been trapped in a geologic safe. For the first one hundred fifty years of the oil era (1850–2000), the name of the game in the oil industry was using geologic knowledge to find either the source rocks or the caprocks, drill thin vertical holes in the ground from the surface to the reservoir and liberate the oil or gas kept in place by the caprock. As an example, most of the major early oil discoveries in the U.S. occurred by drilling into salt domes that had formed on the U.S. Gulf Coast. Salt domes are the ideal caprock structure for oil and gas formations. But although the focus on identifying and accessing these reservoirs was the logical thrust of the oil and gas industry for the past century and a half, it does lend itself to a constant irritating question: would it not be more efficient to directly drill and tap the original source or sedimentary rock?

This had been a curiosity of geologists and petroleum engineers since the beginning of the oil industry but always thwarted by a couple of inconvenient geologic truths. The first is that marine sedimentary shale layers tend to exist in the ground as a type of layer cake, long-wide geological layers that are relatively thin, measuring only a couple of meters thick. A vertical straw wants to find glasses of oil, not baking sheets of oil. The second impediment was the fact that shale rock is dense and brittle, lending itself to a problem of low porosity. Even if you can access the source rock, oil and/or gas doesn’t flow well because there aren’t enough microscopic channels in the rock to facilitate good flow characteristics. Based on these two factors, for one hundred fifty years, shale formations represented unrealized potential but never resulted in much actual production from an oil and gas perspective.

THE BIRTH OF HYDRAULIC FRACTURING

Now let’s return to that little mystery that started showing up in U.S. energy data circa 2005. Despite U.S. energy production reaching a modern low, natural gas production had started to unexpectedly grow. The answer to the mystery was that someone had cracked the shale code, and that someone was a gentleman named George P. Mitchell.

Most oil industry historians consider Mitchell an American businessman, energy entrepreneur and the grandfather of the American shale revolution. Born to Greek immigrants in Galveston, Texas in 1919, Mitchell started his own oil and gas drilling company, Mitchell Energy & Development, after graduating from Texas A&M in 1940 with a degree in petroleum engineering. However, most people have never heard of Mitchell Energy. Until the early 2000s, Mitchell was more well known as a real estate developer and the king of the master-planned housing community, having developed the one-hundred-thousand-person suburb of Houston known as the Woodlands.

Being a small, under-the-radar, independent domestic producer—with a founder-owner who clearly saw the long game—likely contributed to Mitchell Energy’s success in cracking the shale code. Unraveling the riddle of shale was not characterized by a single miracle breakthrough, however; rather, it involved a decades-long process of expensive trial and error, ultimately solved by integrating several existing technologies along with a couple of special refinements—such as the “special sauce” described below. The development process was also characterized by frequent fits and starts that heavily correlated with oil and gas price fluctuations. When the price rose high, everyone became interested in unlocking shale’s perceived bounty; when the price inevitably collapsed, interest in shale subsided. This cycle repeated itself several times across the 1970s through the 1990s.

Though Mitchell Energy ended up as the company credited with the key breakthroughs, in reality, many companies had a hand in and contributed to the winning combination of technologies. Nonetheless, Mitchell Energy did have singular advantages, including being both owner-founded and privately owned (that is, not accountable to shareholders) and having an owner-founder who was patient. Said owner-founder, Mitchell, also put all his eggs into one basket—that basket being the only one the small company could afford. Its affordability derived from the fact that no one else wanted the “basket” in question, a five-thousand-square-mile collection of shale rocks sitting about two miles below the Dallas-Fort Worth area and encompassing much of Northeast Texas—a formation known as the Barnett Shale.

Geologists had recognized the hydrocarbon potential of the Barnett Shale formation for many decades, with geologic estimates of natural gas in place of an astonishing thirty trillion standard cubic feet (approximately 5.5 billion barrels of oil equivalent). However, the challenge was that both the top and bottom of the formation were comprised of thin, dense (that is, impermeable) layers of shale rocks. Shale made up both the source rock and the caprock, with no reservoir rock in between. These types of formations are known in the industry as “tight rock” or “tight oil/gas” formations, and the United States happens to have the most of them in the world, geologically speaking. The tight rocks of the Barnett Shale remained unsolved and economically unviable until the 1979 Iranian Revolution spiked the price of global hydrocarbons. This gave George Mitchell his first—but not last—window of opportunity.

Mitchell Energy drilled the first well in 1981, a conventional vertical drilled well with a first-generation nitrogen foam “frack,” but it did not produce commercially viable quantities of hydrocarbons. And so began the Moby Dick phase of the Mitchell Energy story in the Barnett Shale, with Mitchell playing the Ahab role, always convinced that he could get more out of his Barnett Shale wells and the seemingly fruitless quest to turn shale into a whale.

Over the next twenty years, Mitchell and his team experimented a lot. Through a scientific process of trial and error, they ended up cracking the shale egg by combining several technologies into each well: horizontal (or directional) drilling, downhole drilling and hydraulic fracturing.

HORIZONTAL OR DIRECTIONAL DRILLING

Originally known as “slant” drilling, horizontal or directional drilling has existed as a technique for enhancing oil production and has been used in the oil patch since at least the late 1870s. At that time, it started out as several degrees off vertical, but by the 1940s, it had advanced to full horizontal or ninety degrees through advancements in specialty steel manufacturing, rotary drill bit technology and operator technical expertise.

The first truly horizontal oil well was drilled in Texon, Texas in 1929. This technology then saw sporadic usage across the globe for the next fifty to sixty years, but was considered niche and only practiced by a handful of specialty drilling operations.

THE DRILL BIT

A suite of technologies developed since the 1950s greatly enhanced the control, maneuverability and diagnostic capabilities of the “drill bit.” This, in combination with the computer processing revolution, transformed the data sophistication of the oil patch. I’ve personally heard the technological leap best described through the following anecdote: “Today if you buried a house two miles underneath Texas, we have the drilling rigs to ring the front doorbell.”

HYDRAULIC FRACTURING

Using nitroglycerin and other explosives at the bottom of oil wells to fracture the rocks and “enhance” oil production is a drilling technology with a historic lineage dating back to the 1860s. However, modern hydraulic fracturing was not developed until the 1950s. It received a major boost during the energy crisis of the 1970s and was further refined in subsequent decades.

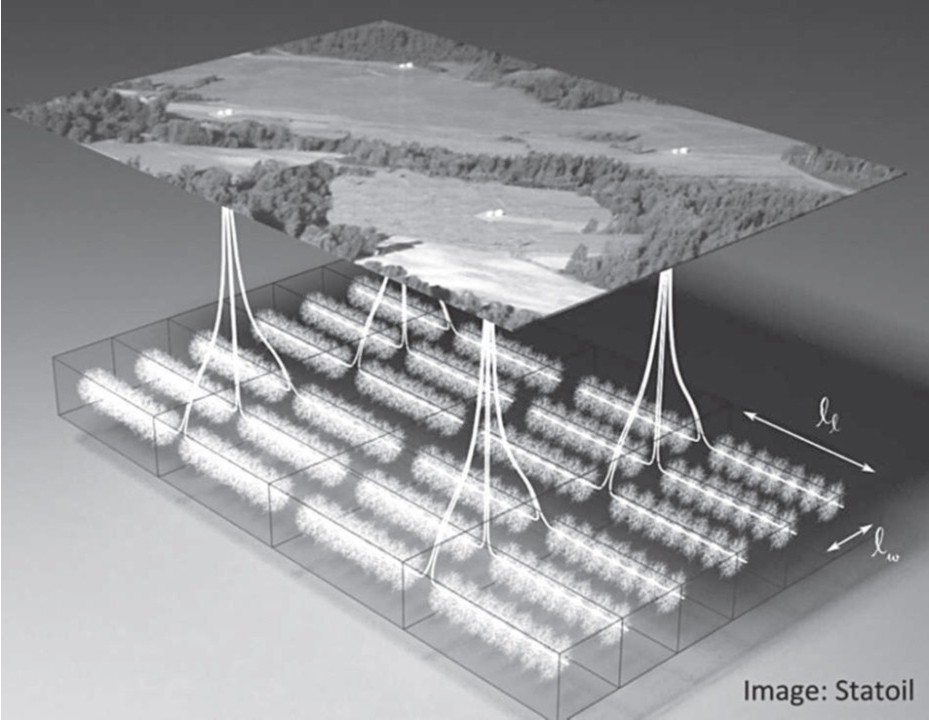

Today, after the horizontal drill pipe is laid, the horizontal pipe is perforated or punctured at set intervals (see Figure 1). At the surface, a slurry mixture is prepared of 98 to 99 percent fresh water and sand; this is also known as “proppant” (see Figure 2). This mixture is pumped to extremely high pressures (greater than 2500 psig) and then injected into the well. The high-pressure water-sand mixture acts as a hammer when it reaches the rock face two miles below the earth, fracturing the rock apart and then creating long fissures that allow the oil and gas to flow. The sand functions as a wedge to keep these newly created fissures open to allow the oil and gas to continue to flow. After this initial fracturing, often done in up to twenty-five to fifty stages along the horizontal section of the pipe, the hydraulic fracturing is stopped. Once this happens, flow is reversed; the fracking fluid is reversed to the surface, followed by oil and gas from the newly created artificial well. Although 99 percent of the hydraulic fracturing solution is water and sand, the remaining 1 percent is probably the most controversial element of the process, as it involves a mixture of chemicals. The chemicals perform two main functions as well as a host of secondary ones.

The first main function is to increase the viscosity of the initial hydraulic water punch in an effort to make the initial hammer strike as forceful as possible. The second primary function involves an additive that aids in uniformly distributing and keeping the sand in suspension. The main additive used to do this is guar gum, made from the guar plant found in India, which commonly also is used as a processed food stabilizing agent. Other additives in the slurry include corrosion inhibitors, freeze point depressors and a viscosity-reducing agent that allows the water slurry to spread farther and create microfissures after the initial high-viscosity punch.

THE SPECIAL SAUCE AND THE SHALE BOOM

After fifteen years of experimenting in the Barnett Shale, in 1997, a Mitchell Energy engineer named Nick Steinsberger suggested adding the “special sauce” to create what is known today as “slick water hydraulic fracturing.” Engineers had already experimented with this recipe and had achieved some success in the adjacent Cotton Valley sandstone of East Texas. This proved to be the final step in cracking the shale code, as it not only reduced costs by 25 percent but also increased gas production enough to recoup the costs of drilling the well.

Using the techniques pioneered by Mitchell Energy, production from the Barnett Shale exploded, increasing sixteen-fold between 2000 and 2008 to almost four billion scfpd, making it the largest onshore gas-producing field in the U.S. at the time. And as the global economy descended into a full-blown financial crisis in late 2008, the lessons learned by Mitchell Energy began to spread throughout the industry. All of a sudden, throughout the United States and Canada, the new techniques developed in North Texas were prompting a second look at shale resources (see Figure 3). Moreover, companies rapidly adopted what had started as a process for extracting natural gas from shale rocks for other shale formations that were primarily oil-bearing. These included companies such as Continental Resources (led by Harold Hamm) and EOG (Enron Oil and Gas), a spin-off subsidiary that ended up being the only surviving component of the now-defunct energy giant.

In the fifteen years since the experimentation and tinkering pioneered by Mitchell Energy in the Barnett Shale, the breakthroughs have fundamentally changed the U.S. energy landscape. (See Table 1 for a comparison of U.S. energy production in 2008 and 2022.) In fact, other than the Internet, fracking may be one of the technological developments that has brought the most benefit to the U.S. economy and individual citizens over the past twenty years. The doubling of U.S. energy production has also had profound impacts on the global economy at large.

In broad terms, as a result of the shale revolution, the U.S. has transformed from having some of the most expensive energy in the world to some of the cheapest. This has reduced the U.S. petroleum trade deficit by upwards of three hundred billion dollars per year. It also saves households fifteen to twenty billion dollars per year in energy costs. Other benefits include the creation of two to three trillion dollars in stock market value for the companies directly involved in shale production; the addition of fifty to seventy-five thousand high-paying manufacturing jobs to the U.S. economy; and the creation of a manufacturing chain to support unconventional drilling.

There are also a number of other second- and third-order benefits attributable to the U.S. shale revolution. First, the U.S. has become a large exporter of crude oil, turning U.S. oil pricing from import parity to export parity and improving the cost basis (that is, the price that consumers pay at the pump) for all U.S. refining and U.S. refined products, excluding the Northeast and the West Coast.

Second, the U.S. has become the largest exporter of hydrocarbons in the Western Hemisphere. Almost all of Latin America is dependent on U.S. product exports to some degree.

Third, the shale revolution resulted in the construction of ten to twenty world-scale petrochemical projects in the U.S., driven by affordable energy and cheap molecules. Prior to the shale revolution, all of these would have been constructed in the Middle East or Asia.

Fourth, this same effect has been felt in U.S. fertilizer production. As many new facilities have been constructed, U.S. production has increased by 50 percent, and imports of fertilizers have fallen in half.

Finally, the shale revolution dramatically reduced U.S. energy production CO2 emissions to pre-1990 levels. This is because the oversupply and low price of natural gas drove many utilities to replace coal-fired power generation with natural-gas-fired generation; this was done on the basis of cost, versus environmental compliance (see Figure 4).

THE CHALLENGES

Despite overwhelming economic, environmental and energy security benefits, the process of tight oil drilling—hydraulic fracturing—is not without its detractors and issues. Most of the negative attention directed against hydraulic fracturing comes from the hard environmental movement; although their tactics tend to shift around, their core philosophy is that any increase in hydrocarbon production is undesirable. Because unconventional drilling techniques increase hydrocarbon production, the process is, by their definition, bad.

As is often the case in such matters, the reality is a bit more nuanced and complicated. The issues with hydraulic fracturing generally fall into one of four categories: (1) cementing failures at the well head; (2) “flowback” issues; (3) flaring or venting issues; and (4) traffic issues. All of these are solvable and manageable with existing techniques and practices.

The second category refers to the storing and processing of the “flowback” that occurs after the hydraulic fracturing is complete, when the flow reverses from down the well back to the surface. Management of “flowback” and the issue of well head cementing are the two challenges that have garnered the most media attention. If these are not done properly, both can result in groundwater and aquifer contamination. Hydrocarbon contamination into groundwater is what results in the highly circulated Internet videos of individuals lighting the water coming out of their sink faucets on fire.

In 2008, the U.S. had eighteen thousand oil and gas wells that produced more than one hundred barrels per day of oil. (The total number of oil and gas wells in the U.S. producing at least one barrel of oil per day was a much larger number, closer to nine hundred twenty-five thousand.) By 2020, this number had increased by over 300 percent to almost fifty-seven thousand oil and gas wells producing more than one hundred barrels per day. More wells being drilled results in more holes having to be cemented. Although all oil and gas wells require cementing, the sheer increase in cementing jobs with all the new wells increases the probability of a poor cementing job and some type of surface-level contamination (see Figure 5).

The third issue refers to flaring or venting after the well is complete. When a well is hydraulic fractured and production begins, the resulting hydrocarbon flow is often (almost always) mixed flow, containing crude oil or condensate (very light crude oil), volatile liquids (NGLs) and gas. Each type of flow requires similar but separate infrastructure to deliver the hydrocarbon type to market. When natural gas prices were low (2008–2020), the infrastructure cost to deliver the gas to market often did not meet economic thresholds and as such was often burned directly at the well head using a burner known as a flare. Price and federal- and state-level environmental restrictions often drive recovery of this gas eventually, but not initially.

Although a well itself has a relatively small above-ground footprint, the process of drilling and hydraulically fracturing the well comes with a lot of traffic and can give rise to local congestion. Often, the process involves heavy trucks that are hauling pipe, cement, water and equipment to the well head, as well as drilling rigs and the hydraulic fracturing pressure pumping trucks. All of this can create a large increase in local traffic, often on single-lane, poor-quality and remote roads.

On the other hand, one of the reasons that hydraulic fracturing was able to take off so quickly was that most of the resource basins are located in low-population-density areas, many outside of western Pennsylvania and the Dallas-Fort Worth area, where the initial environmental problems occurred. West, East and Central Texas, North Dakota, northern Colorado, Wyoming and Arkansas are all low-population-density areas (see Figure 3).

A DIFFERENT BUSINESS MODEL

There are a couple of additional points to make regarding unconventional drilling practices, which are fundamentally different from traditional hydrocarbon wells in several respects. First, individual unconventional wells are relatively small. Good wells produce only one to two thousand barrels per day, whereas good traditional wells typically produce in excess of ten thousand barrels per day. Second, individual onshore unconventional wells have very little geologic risk but a much higher degree of completion or manufacturing risk. Finally, unconventional shale wells have much steeper decline rates than traditional wells; in other words, the loss of production over time is greater in unconventional than traditional wells.

All of this is to say that the business model around unconventional production is fundamentally different than the traditional oil business model. It requires drilling many times more wells, each of which produces less. The key to success is repeatability, making the process more akin to a complex manufacturing process than a geologic treasure hunt.

WATER CHALLENGES

In addition to well head cementing challenges, the large number of wells being drilled and the use of water in the drilling process leads to the second main engineering-environmental challenge with the hydraulic fracturing process—managing the water cycle around wells. In addition to using a large amount of water, hydraulic fracturing has the second-order challenge of managing that water when it returns to the surface, post-hydraulic fracturing (see Figure 6).

The average hydraulically fractured well uses about two million gallons of water (or about three Olympic-sized swimming pools per well). This scale of water usage is a big number—a real resource challenge—and is prone to heavy political and environmental scrutiny. Ten thousand hydraulic-fractured wells per year would result in an increased water demand of twenty thousand million gallons of water per year. This represents about 5 percent of total U.S. fresh and saline water withdrawals, estimated at three hundred fifty to four hundred thousand million gallons per year by the U.S. Geologic Service.

In the early days of hydraulic fracturing, companies procured the water from the local or regional municipality, and often initially stored the polluted hydraulic flowback water in open-air pits before it was vacuumed up and sent away for disposal. Disposal consisted of either dropping the contaminated water off at a regional or municipal facility for treatment, or drilling a water well and disposing of the water underground. All of this created numerous knock-on-effect problems. Temporary open-air pit storage of hydrocarbon-contaminated water can lead to weathering (usually scents and odors) and, through rainfall or poor containment, can leak and mix with drinking water sources. Further, the need to continually drill wastewater disposal wells is not only expensive but can lead to micro-quakes, as wastewater wells are often drilled to a shallower depth than hydrocarbon wells. These micro-quakes are real, resulting in many media headlines and open speculation that hydraulic fracturing causes earthquakes, but they also have been heavily sensationalized. The earthquake phenomena seem to be closely associated with wastewater disposal wells, and they have happened only in large volume in Oklahoma (in other words, they are geologically specific). Most importantly, these micro-quakes are small. They register a negative number on the Richter scale—about one-one millionth the power of your typical San Andreas fault line movement—and are akin to the force of an eighteen-wheeler passing you on the highway.

The oil drillers are well aware of the water challenges associated with unconventional drilling. Similar to the trial-and-error roots of the U.S. shale revolution and the excessive cost focus associated with any intensive manufacturing process, the shale drillers have evolved to meet the challenges of their environment. Today, a large percentage of the water used in hydraulic fracturing is subject to a closed recycle loop, particularly as drilling has been concentrated in a handful of geographic locations and as common infrastructure is built out. In the closed water loop model, shale drillers extract fresh water from purpose-drilled aquifer wells. They store flowback water in environmentally sealed tanks and send the flowback water to purpose-built water treatment plants that remove the water contaminants and recycle the flow for the next hydraulic fracturing job. The amount of recycled water being used varies by production and by basin. At present, it is typically about 40 to 50 percent recycled, up from 10 to 20 percent ten years ago.

A QUESTION OF TRADE-OFFs

The shale drilling revolution in the U.S. has produced fantastic results, leading to a greater than 100 percent growth in U.S. hydrocarbon production in just over a decade. However, this rapid increase in energy production comes with trade-offs. Shale drilling through hydraulic fracturing is water-, equipment- and resource-intensive, and requires drilling a tremendous number of holes in the ground. If not done properly by responsible operators, water and air contamination hazards can occur and have occurred, though in small numbers relative to the number of wells drilled. Moreover, when issues arise, they tend to be resolved privately between the driller and the landowner, not in lawsuits or major legal actions. Hydraulic fracturing has never produced an accident equivalent to the Exxon-Valdez incident.

Nonetheless, social media—often pushed by the no-hydrocarbon contingent—have helped accidents achieve widespread notoriety. Those critics almost always fail to mention the widespread benefits received by the U.S. population at large from the doubling of domestic hydrocarbon production. Regions like New York, which have banned hydraulic fracturing, do not have a large amount of shale resources and were never going to be a center of drilling activity to begin with.

If you had asked any post-WW2 U.S. President, “Would you trade 5 percent of U.S. water for a doubling of U.S. energy production?”, every one of them would have taken that trade without blinking, even the more recent green-sympathetic presidents. Another way to think about the shale drilling revolution and the resource trade-off is to imagine a world where the key breakthroughs led by Mitchell Energy either failed to occur, failed to propagate or were halted mid-development by the no-hydrocarbon crowd. In that world, U.S. energy dollars would be sent overseas to finance imports, rather than staying at home in the form of American company profitability and jobs. That world would also offer fewer high-paying, non-college-tuition manufacturing jobs in the U.S., would likely require (or lead to) an increasing level of military interventionism in the Middle East, would mean that almost all energy prices globally would be higher, would expose the U.S. to even more global energy volatility (such as the Russia-Ukraine War) and would cause head-to-head U.S.-China energy competition for the last available barrel. (Casual readers can make the connection; since 2008, U.S. interventionism in the Middle East has subsided substantially when compared to the 1990–2008 period.)

This, however, is not the world in which we live. I, for one, am grateful that the great U.S. strategic weakness of the 1970s to 2000s—imported foreign energy dependence—has been flipped on its axis. That great four-decade macroeconomic exposure has now become a fundamental geopolitical strength of the U.S., and it is all a byproduct of rocks no one wanted, persistence and a pinch of American ingenuity.

SIDEBARS

WHY THE U.S.?

A frequent question asked about the U.S. shale revolution is, why did this unique suite of technologies get combined in the U.S., and why has the U.S. become the epicenter of shale drilling? Similar resource basins exist across the planet in places such as Russia, China, Argentina, Australia, Libya and Central Europe. The answer is often reductively simplified to “U.S. ingenuity and entrepreneurial spirit,” but this obscures the actual factors, which are in my opinion more interesting. They include the following:

MINERAL RIGHTS LAWS: The U.S. is one of the few places in the world where private landowners possess the mineral rights underneath their land. (This excludes federally owned land.) The importance of this is that it entitles private landowners to receive production royalties when companies drill oil and gas wells on their property, which in turn has provided a powerful steroid to the rapid proliferation of unconventional drilling. This has allowed private landowners, particularly in Texas and North Dakota, to financially participate in the rapid increase in production, but also has provided the acreage necessary for the shale drilling revolution.

TECHNICAL EXPERTISE: With few exceptions, the U.S. is the unquestioned leader in drilling expertise and engineering know-how. This is based in part on the extensive history of U.S. drilling activity. Since the start of the Oil Era (1850), roughly half of all the oil and gas wells drilled in the world are located in the U.S. It should not be surprising that most of the global oil service companies (Baker Hughes, Halliburton, National Oilwell Varco) are U.S.-based companies.

CAPITAL ALLOCATION: Unconventional drilling is capital-intensive, requiring a sizable up-front investment and tolerance for slower cash recovery as the well produces. This requires a stable and efficient capital formation system willing to take risks on potential capital recovery. Similar to the private-public hybrid model regarding mineral rights, the U.S. has such a system, and it is probably the most successful capital allocation system the world has ever known. Many of the other countries that have similar shale resources don’t have anything close to the U.S. capital markets.

FRESH WATER: The U.S. has it, but many other prospective shale drilling basins do not. The lack of water significantly changes the economics of shale drilling. China offers the prime example of the freshwater constraint in that China has large potential shale basins and high technical expertise, but is among the most water-constrained regions in the world.

INFRASTRUCTURE: In the same vein as the U.S.’s prolific drilling history, the U.S. had the largest oil and gas transportation and processing infrastructure in the world even before the shale revolution. Much of this infrastructure had been under-utilized, so it proved invaluable in absorbing the first ten or so years of shale production growth, and it greatly reduced the capital requirements to bring shale production to market. As an example, almost all of the LNG import terminals that were constructed in the mid-2000s to regasify foreign LNG have been repurposed as LNG export terminals in the past ten years, allowing export of surplus U.S. natural gas. The conversion of import to export terminal reuses the marine berthing and storage assets; as such, facilities can be converted to an export terminal at a fraction of the cost of new greenfield construction.

MAJOR SHALE-PRODUCING REGIONS OF THE U.S.

The major shale-producing regions of the U.S. can roughly be split into primarily oil, wet natural gas or dry natural gas.

They include the following:

CRUDE OIL

- Permian: West Texas

- Bakken: Northwest North Dakota

WET GAS, NATURAL GAS AND NATURAL GAS LIQUIDS

- Eagle Ford: Central Texas

- Niobrara: Colorado and Wyoming

- Woodford: Oklahoma

- Utica: Eastern Ohio

DRY NATURAL GAS

- Barnett: North Texas

- Haynesville: East Texas

- Fayetteville: Arkansas

- Marcellus: Western Pennsylvania and West Virginia

This article appeared in Wise Traditions in Food, Farming and the Healing Arts, the quarterly journal of the Weston A. Price Foundation, Winter 2022

🖨️ Print post

Leave a Reply